CIPA (Camera & Imaging Products Association) took advantage of CP+ 2025 to unveil its annual report on major trends in the digital camera market for the year 2024. Overall, shipments are up 10% on last year. The sector is also being boosted by strong demand from China, now the world’s leading market.

Sommaire

- Global camera market recovers slightly

- A sharp rise in the average price of cameras and lenses

- The great leap forward in the Chinese market

- Slight growth for compacts and the agony of SLRs

- Targets: value growth driven by full-frame products

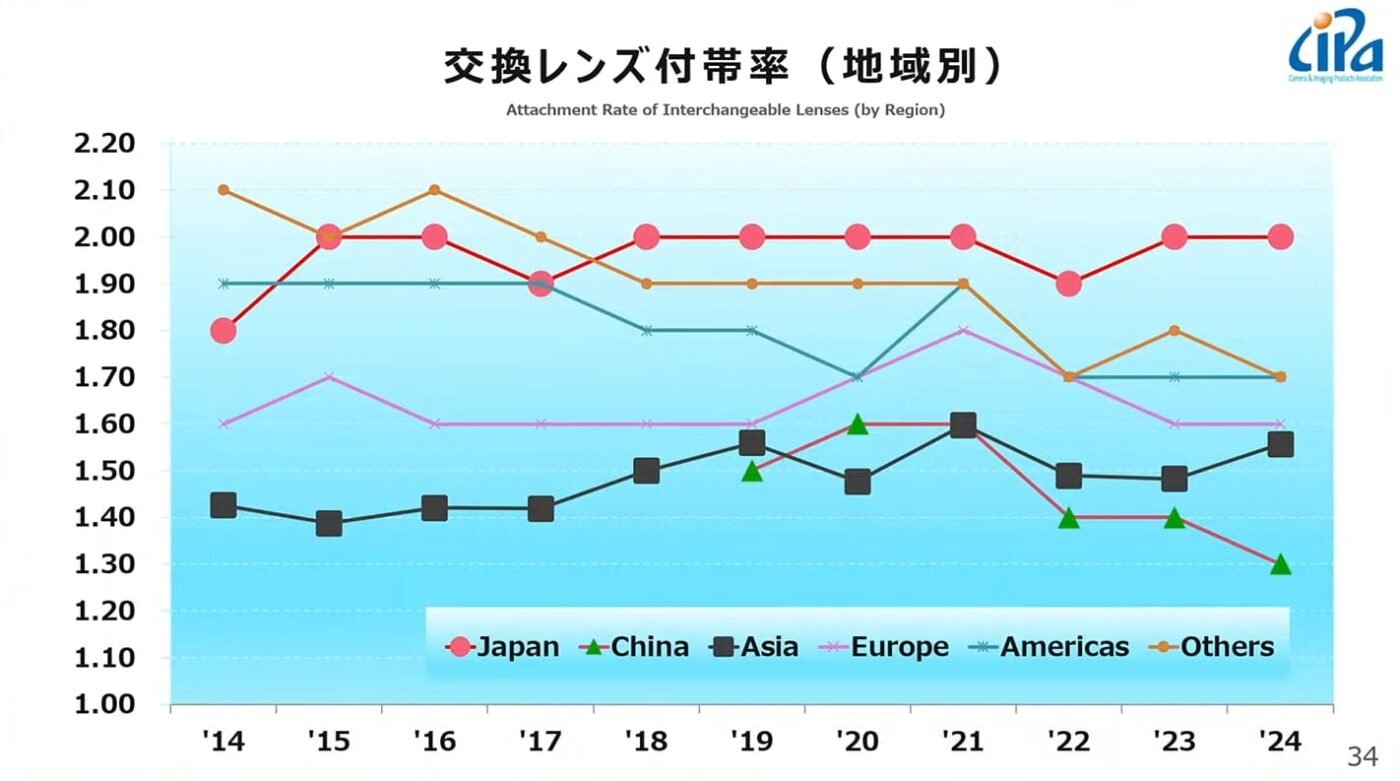

- 1.65 targets per housing – but significant regional disparities

- A rather cautious 2025 forecast

- An interesting study of Chinese photographers

Global camera market recovers slightly

As every year at this time, CIPA releases the results of its analysis of camera shipments over the past year. The figures for 2024 are relatively encouraging.

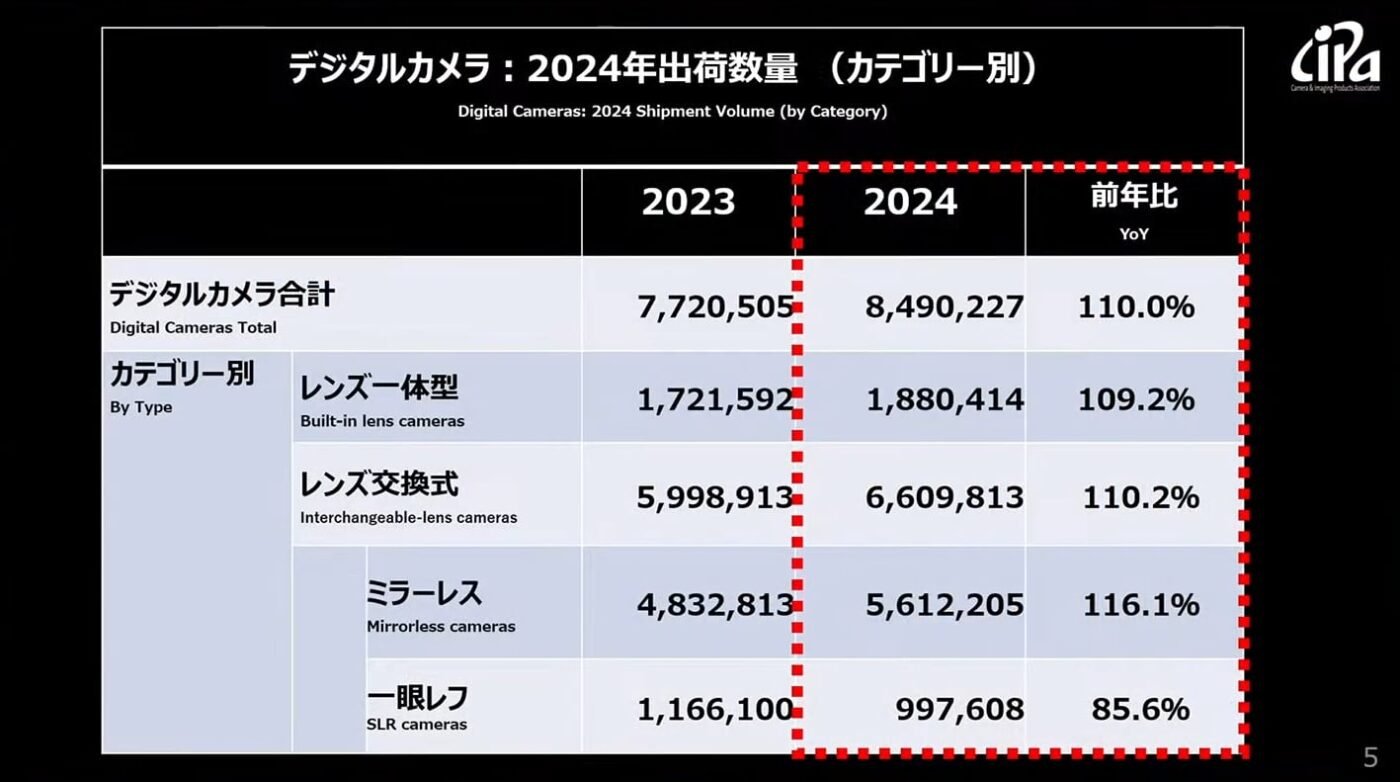

CIPA noted a 10% increase in global camera shipments. Almost 8.5 million units were delivered by the various manufacturers over the past year, compared with 7.7 million in 2023. In detail, deliveries of compact cameras rose by 9.2% (1.88 million units), while shipments of interchangeable-lens cameras increased by 10.2% (6.6 million units).

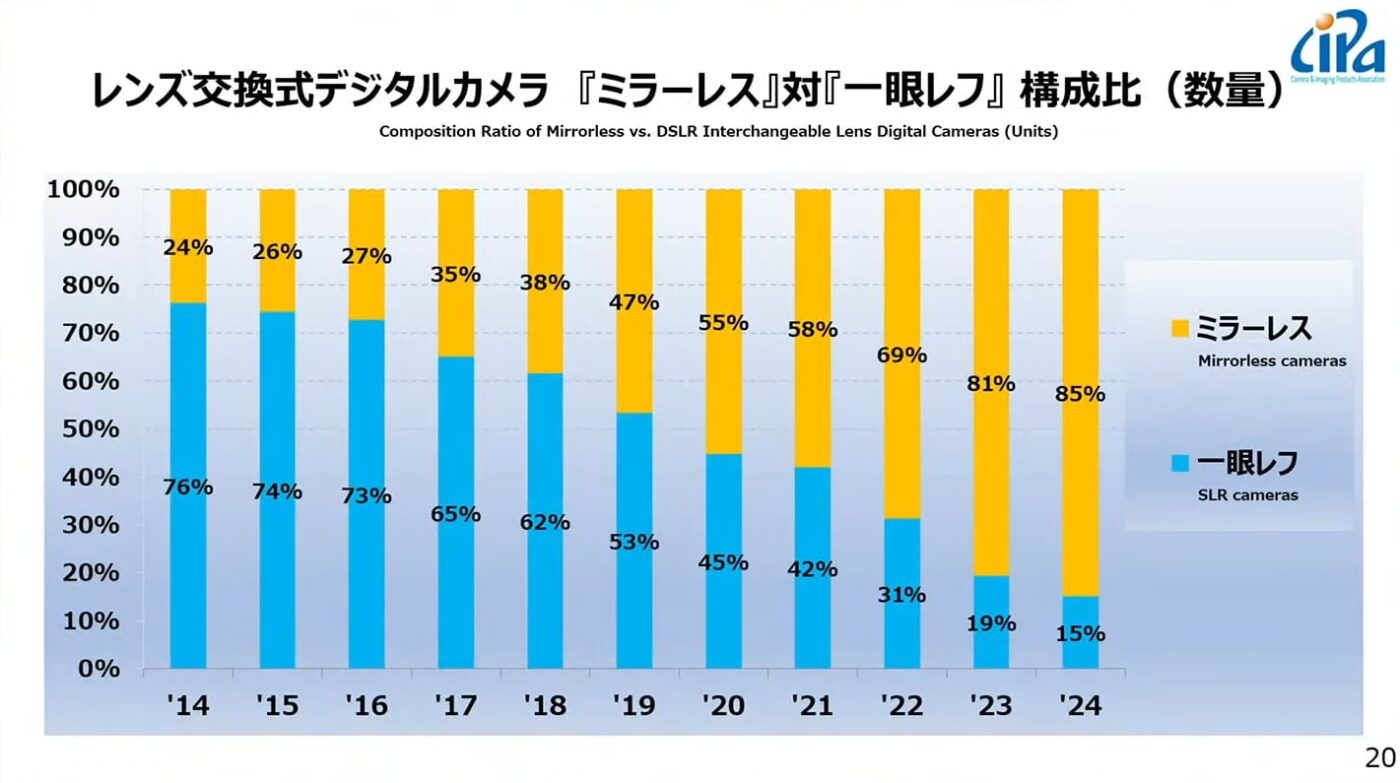

Hybrids are growing strongly (+16%, 5.6 million units shipped vs. 4.8 million in 2023). On the other hand, SLRs continue to decline (-14.4%), with shipment volumes falling below the million-unit mark for the 1st time.

Finally, lens shipments rose by 7% (10.3 million units delivered vs. 9.57 million last year).

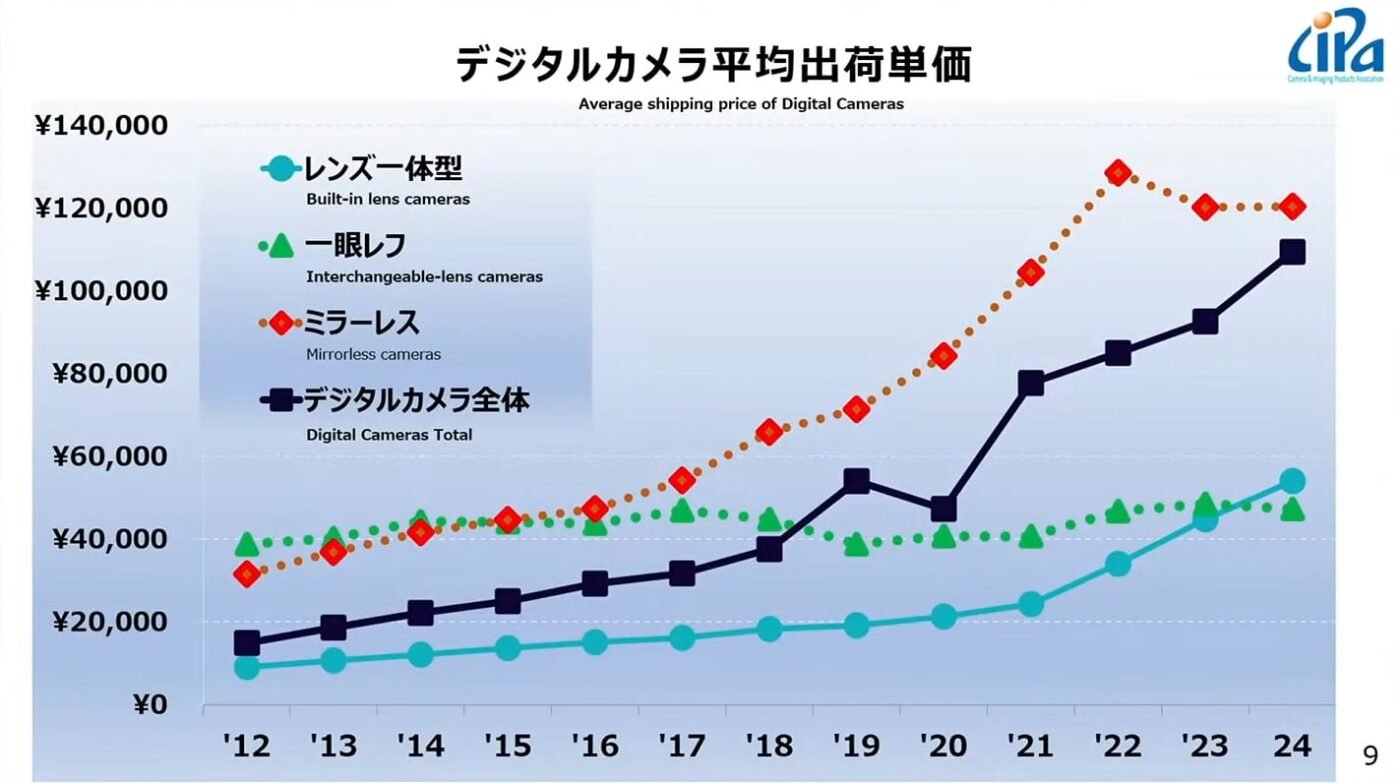

A sharp rise in the average price of cameras and lenses

The average price of cameras will rise sharply, from 90,000 yen(€576) in 2023 to 110,000 yen(€704) in 2024. The disparities between the different categories of equipment are considerable: the average price of hybrids stabilizes at around 120,000 yen(€768), while that of compacts rises from 40,000 yen(€256) to almost 60,000 yen(€384). The strong growth in expert compacts is certainly not to blame. On the other hand, the agony of SLRs is reflected in a slightly lower average price, approaching the 40,000 yen(€256) mark.

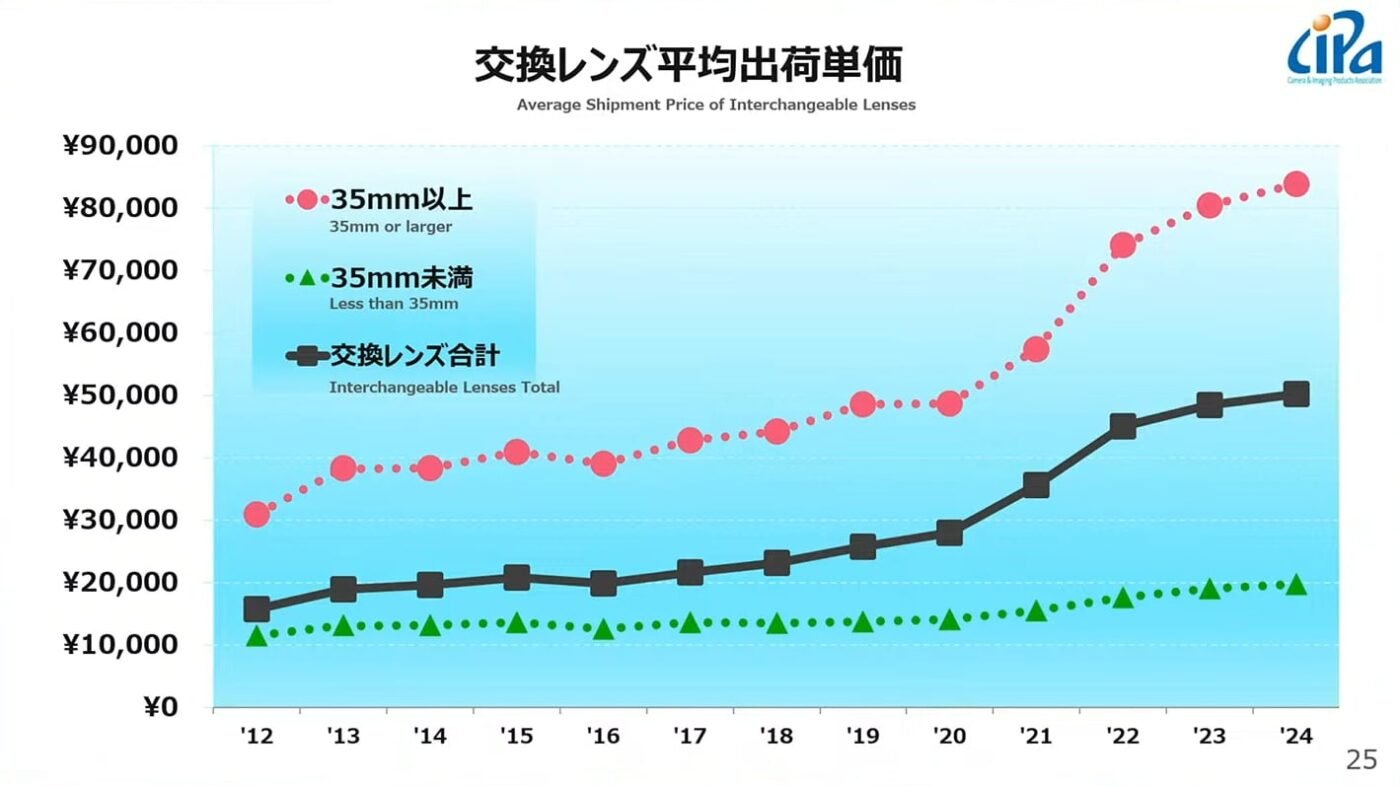

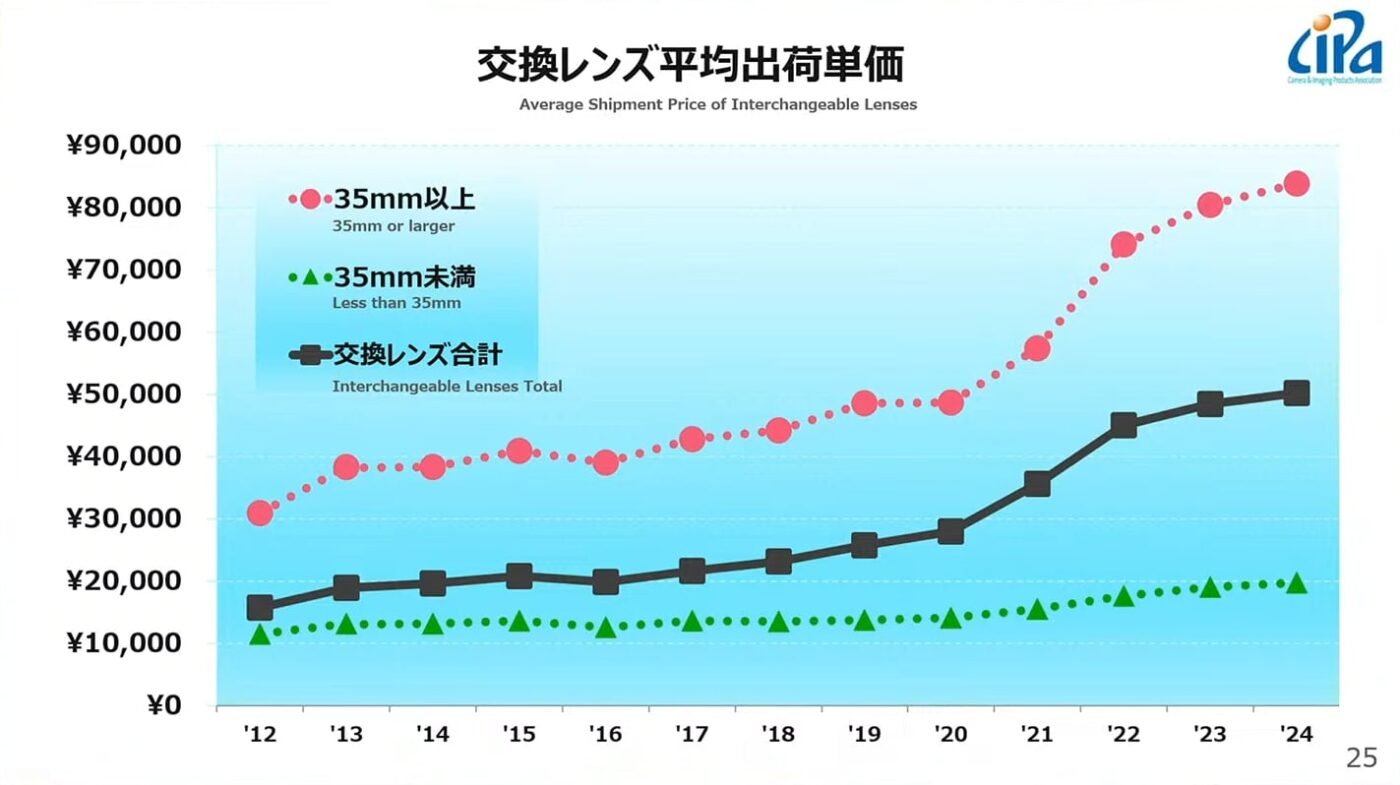

Similarly, the average price of lenses has risen slightly, to around 50,000 yen(€320). The gap between the price of lenses for full-frame sensors (and beyond) and that of lenses for APS-C and Micro 4/3 is abysmal. The average price of a full-frame or medium-format lens is 85,000 yen(€544). Conversely, small sensor lenses cost around 20,000 yen(€128).

The great leap forward in the Chinese market

While all markets return to growth, China seems to have boosted camera sales figures. Of all the regions studied by CIPA, the Middle Kingdom recorded the strongest growth (+24.5%).

By comparison, growth in other markets appears more modest, though promising. For example, the Japanese domestic market is growing by 11%, and the American market by 7.3%. By contrast, the European market will grow by “only” +3.1% in 2024 – compared with the 13.5% drop in 2023.

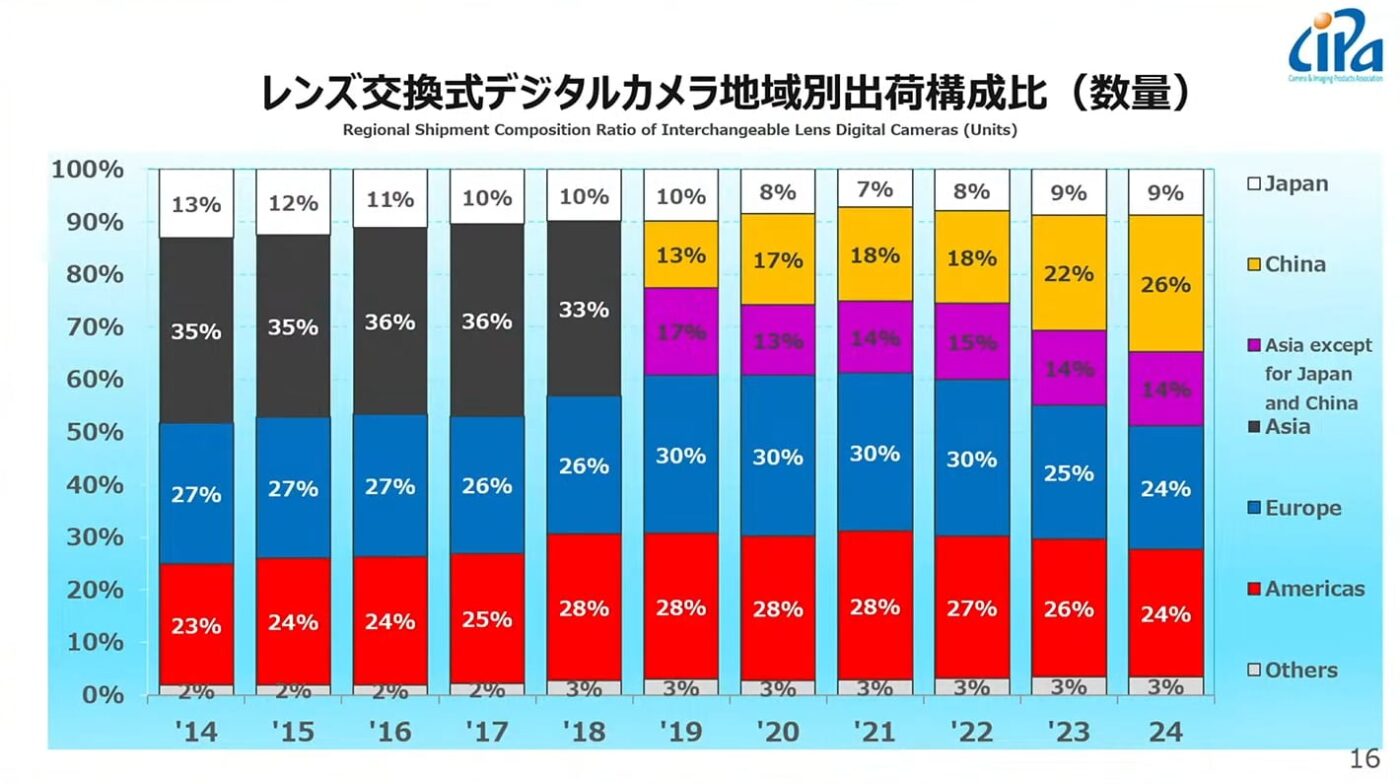

This trend is clearly confirmed when we analyze the figures for shipments of interchangeable-lens bodies (hybrids and SLRs). Compared to 2023, shipments to China are up 30.5%! Shipments to Japan are up by 10%, while those to Europe and America are on a par, with a timid 2% increase.

As a result, China’s weight in the photo market continues to grow. It now accounts for 26% of market share in the SLR/hybrid sector – up from 22% last year. So much so, in fact, that it has overtaken the European and American markets (24% market share respectively). Japan’s market share remains stable at 9%. All in all, Asia now accounts for half of all SLR and hybrid camera shipments worldwide(49%, versus 45% last year).

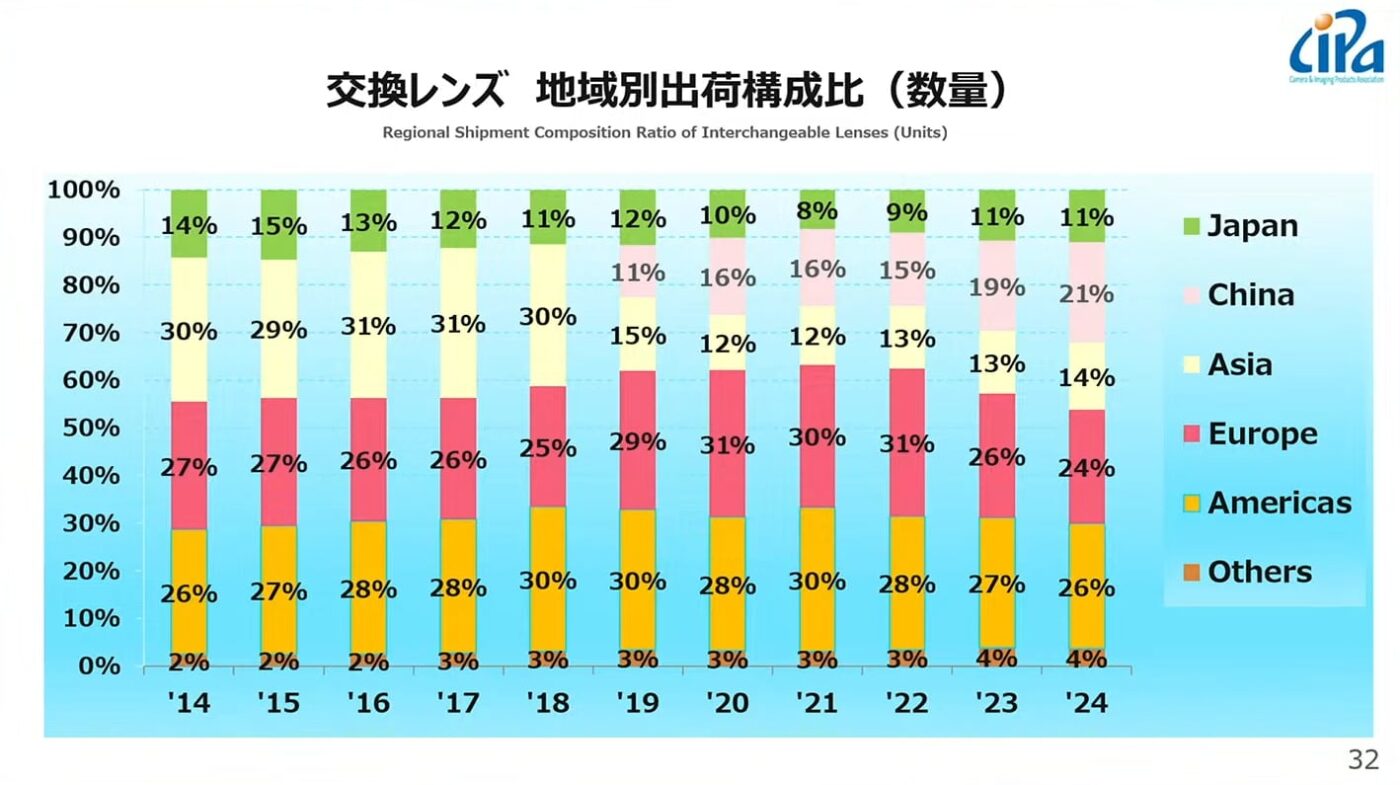

In terms of targets, the breakdown is slightly different. America remains in the lead, accounting for 26% of shipments, followed by Europe (24%). China comes 3rd, with 21% of total volume.

Slight growth for compacts and the agony of SLRs

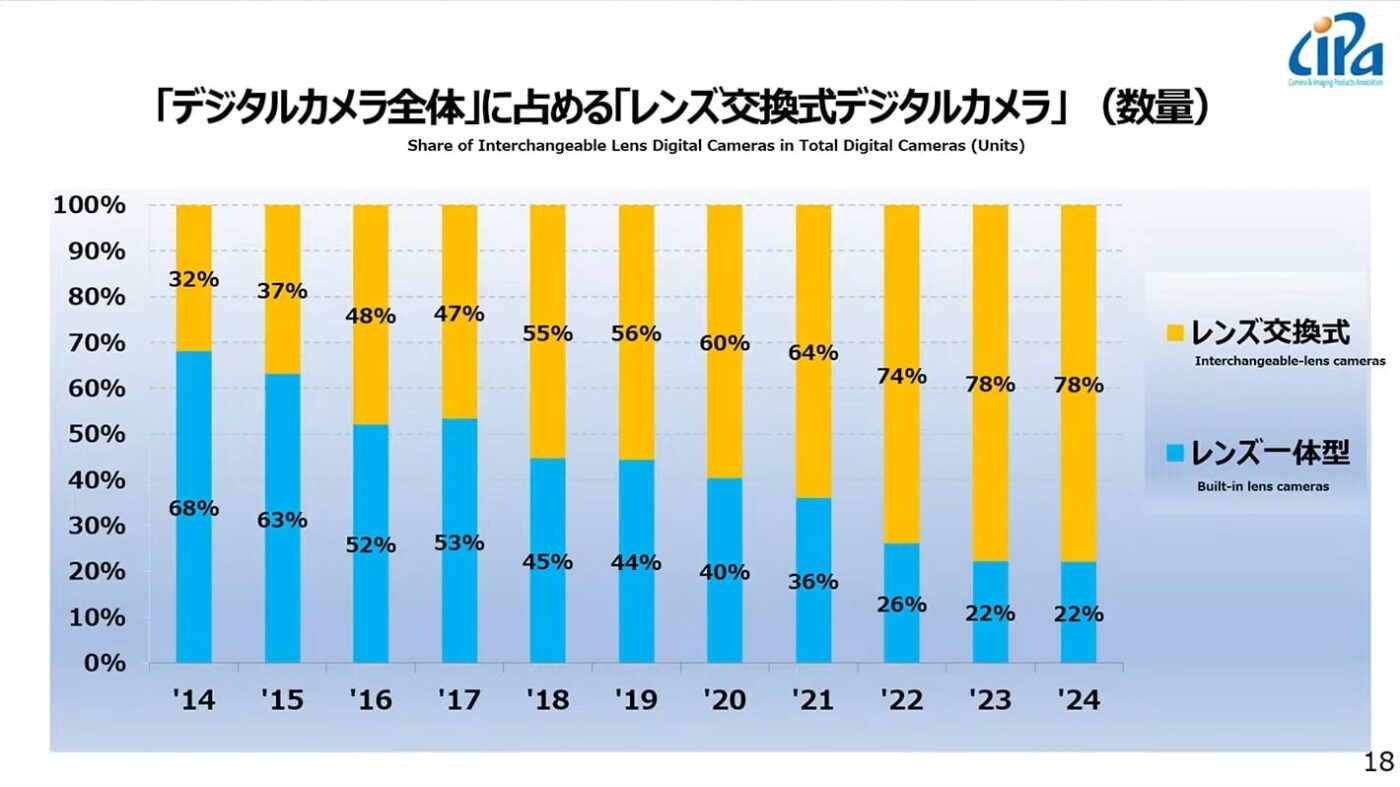

Overall, interchangeable-lens bodies (hybrids and SLRs) account for 78% of total camera shipment volume. However, they account for 88% of total value, with the weight of compacts rising from 11% to 12% between 2023 and 2024.

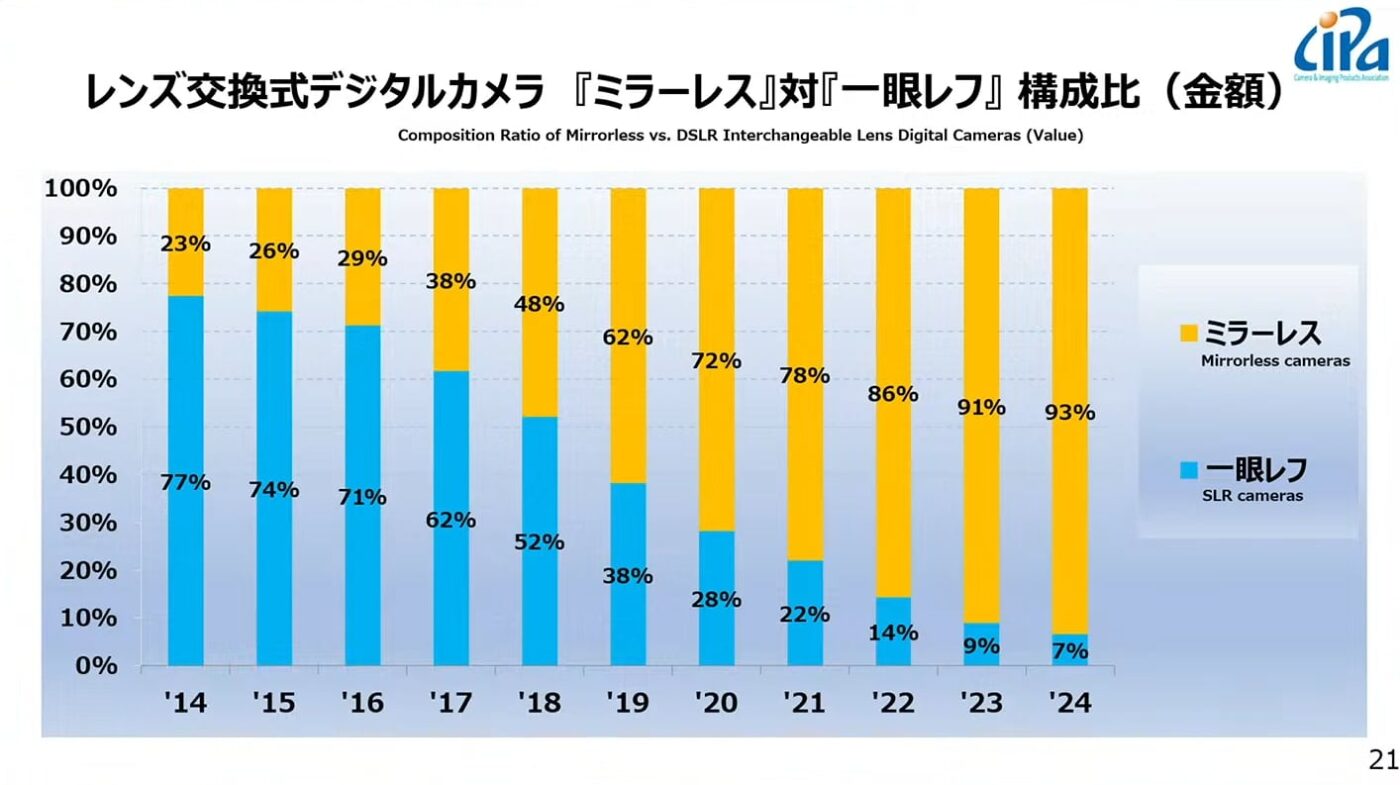

On the other hand, the role of SLRs continues to decline. In terms of volume, they have fallen from 19% to just 15% of shipments in one year. In terms of value, they now account for just 7% of the total. It has to be said that the number of manufacturers producing SLRs (and the number of models on offer) is becoming ever smaller…

Targets: value growth driven by full-frame products

An analysis of lens sales reveals several trends. In addition to volume growth (+7% in 2024), the average price of lenses has soared – but not all segments are equal. While small-format lenses (APS-C, Micro 4/3) have remained relatively stable, the average price of lenses for 35mm and larger sensors has risen spectacularly.

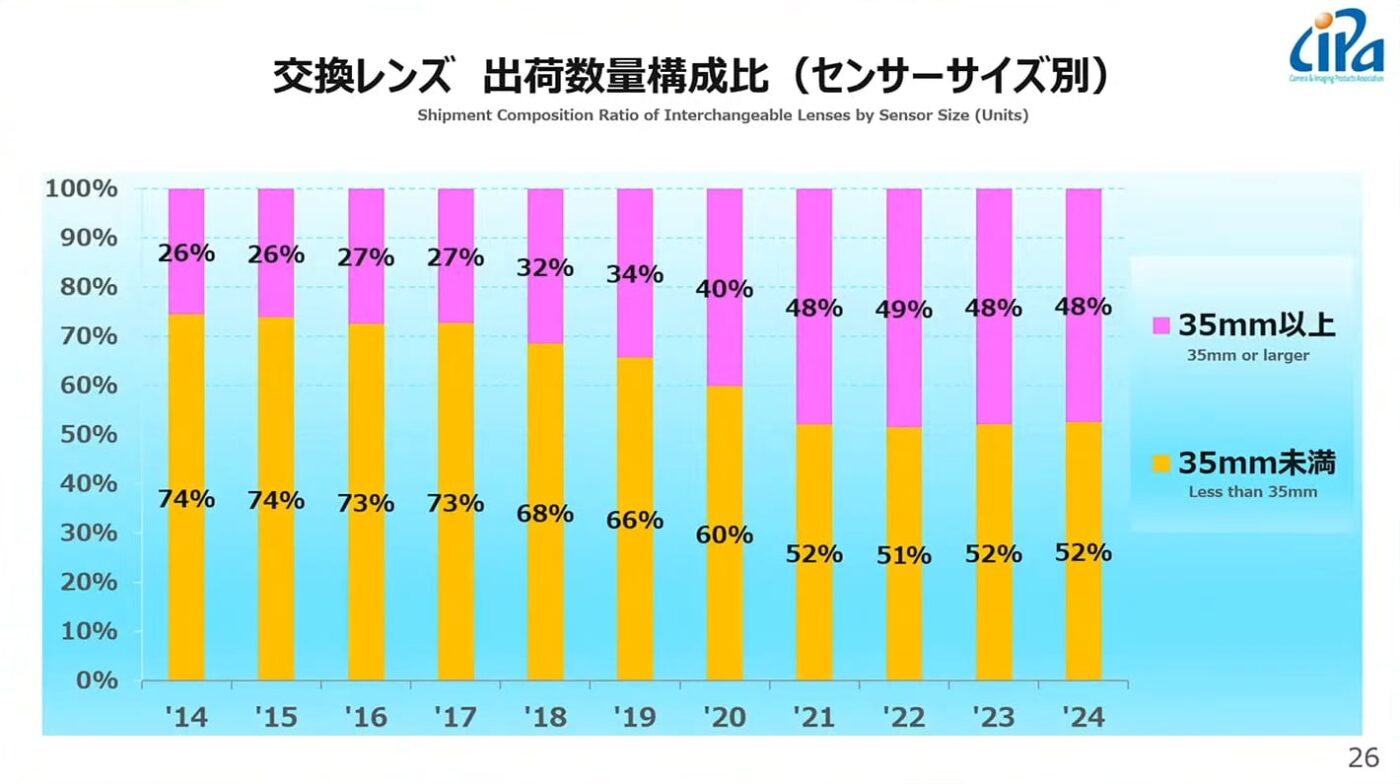

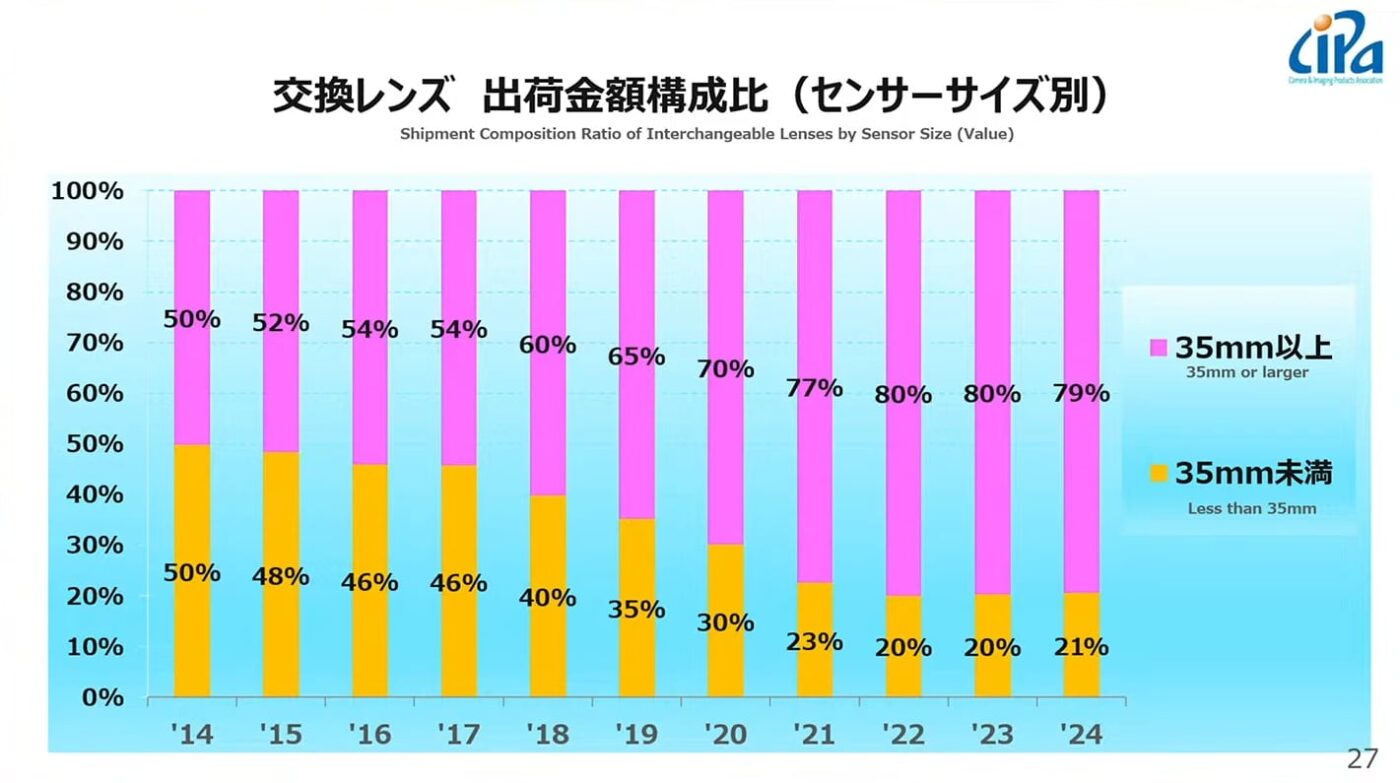

In all, lenses for large-format sensors (full-frame + medium-frame) account for 48% of total shipment volume ; however, they embody 79% of total shipment value (versus just 21% for APS-C and Micro 4/3). To put it plainly: full-frame lenses are being sold slightly less frequently – but at a much higher price than APS-C and Micro 4/3 lenses.

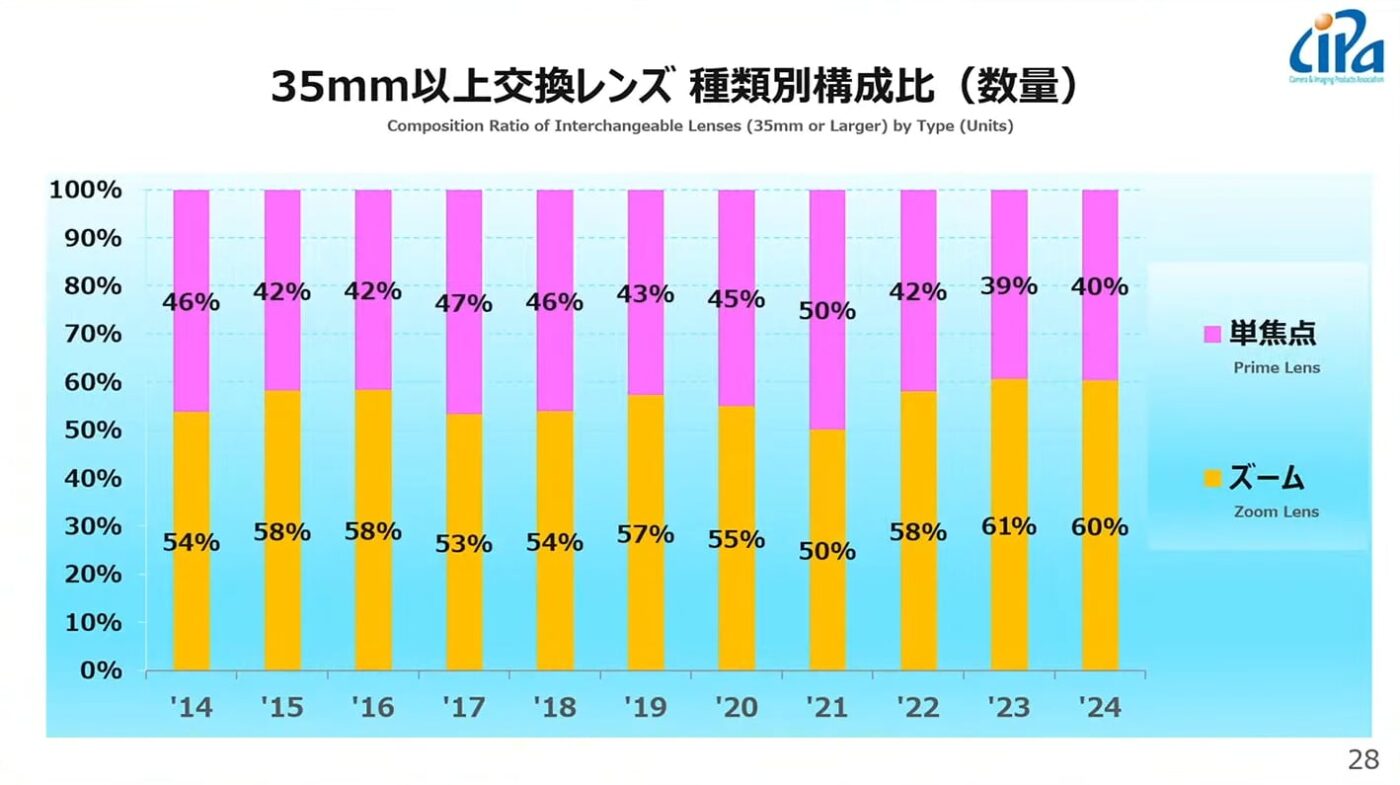

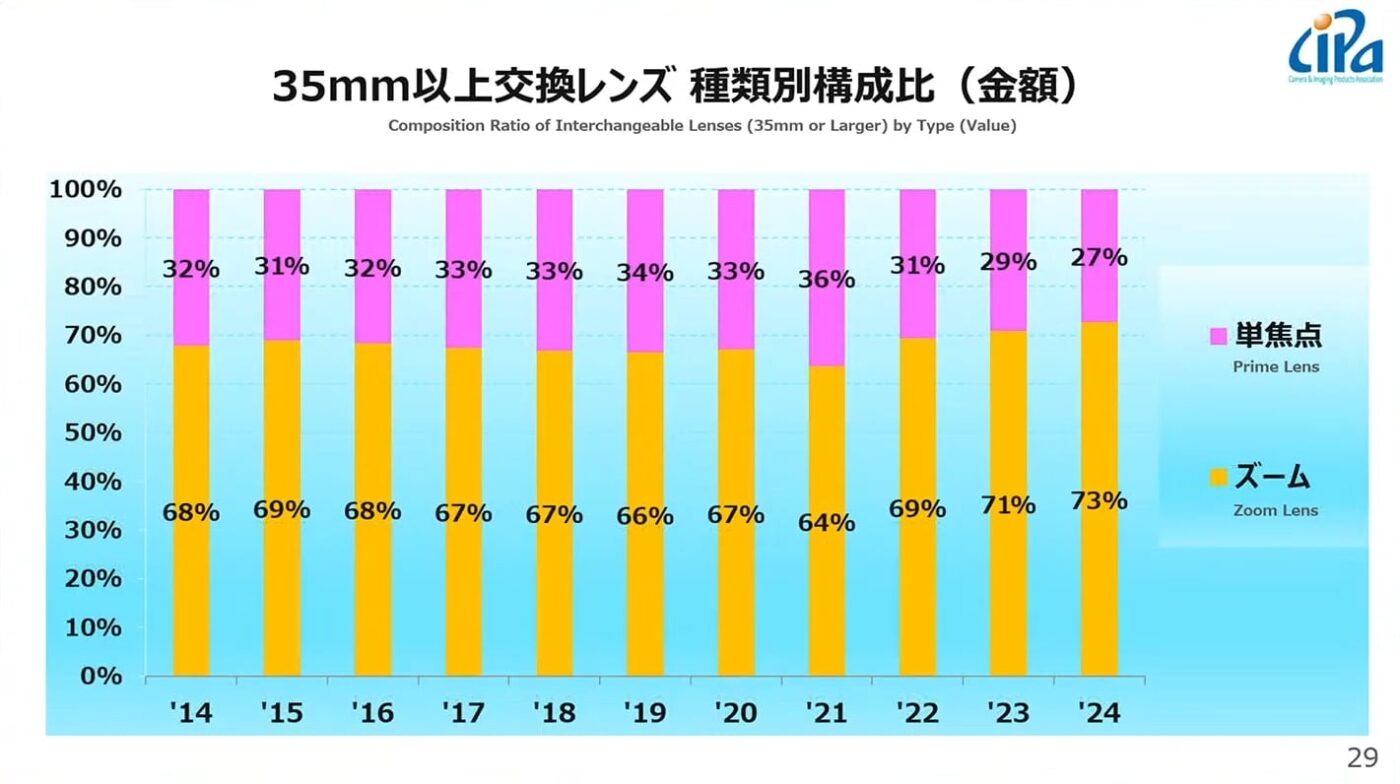

In detail, zoom lenses account for 60% of total shipment volume (and… 40% for fixed focal lengths); similarly, zoom lenses represent 73% of total shipment value (and therefore 27% for fixed focal lengths).

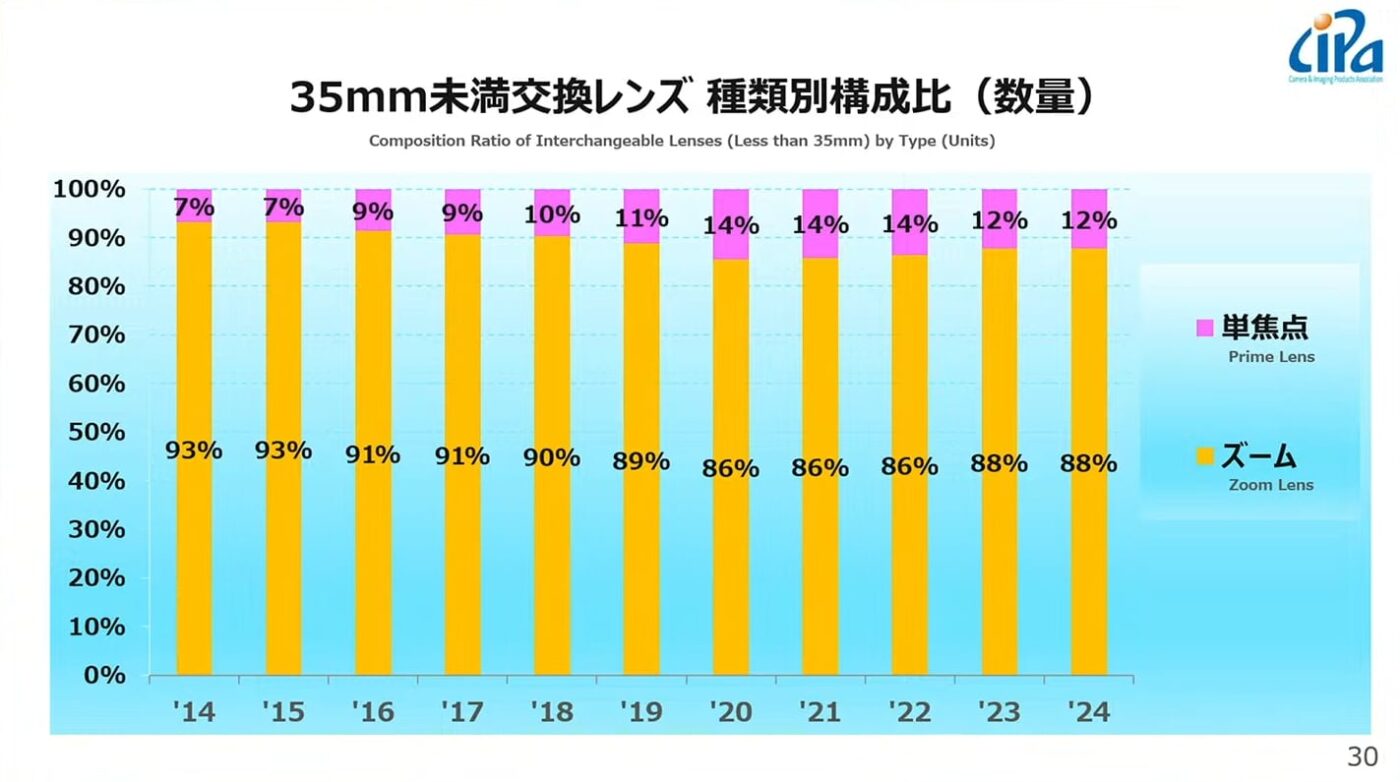

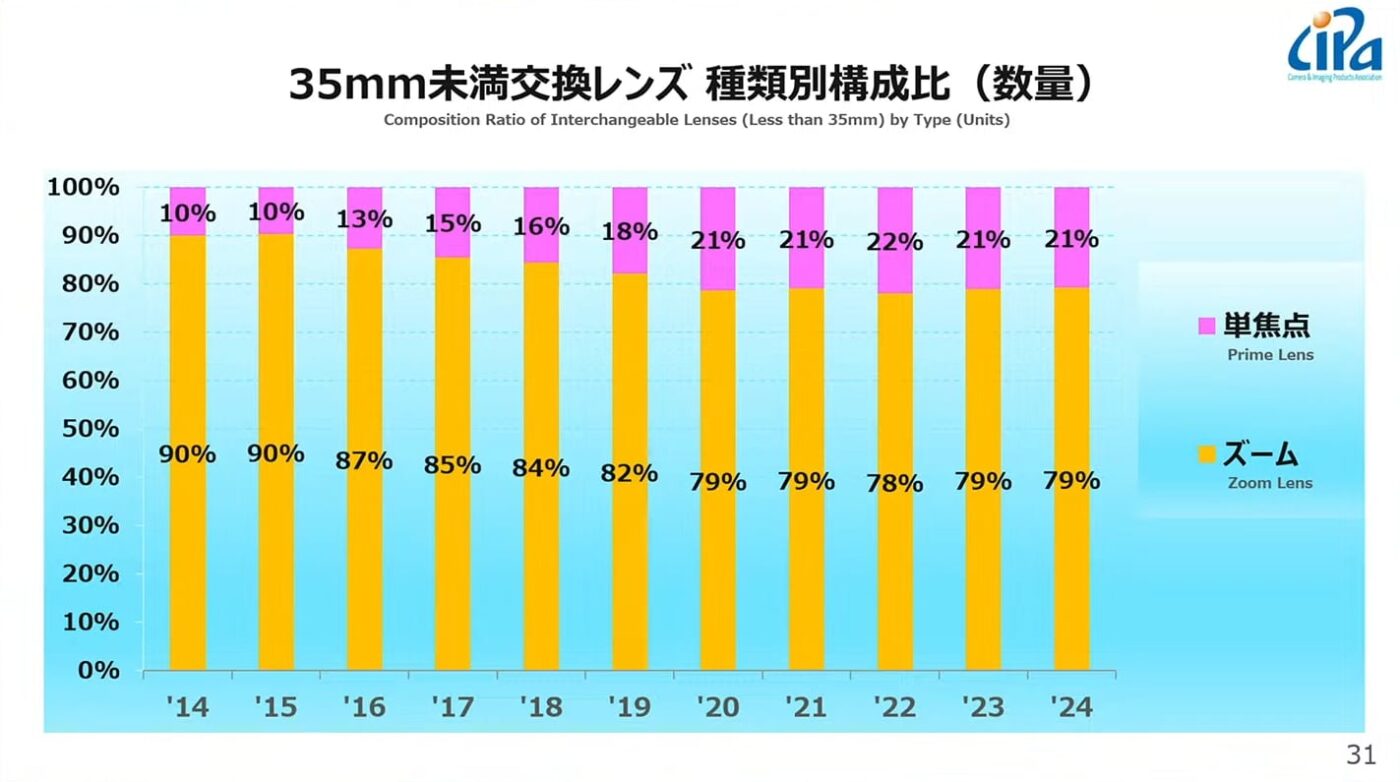

This is even more true for small sensor lenses (APS-C and Micro 4/3), where zooms account for 88% of PDM in volume, and 79% of PDM in value.

1.65 targets per housing – but significant regional disparities

As mentioned above, lens shipments increased by 7%, with a total of 10 million units shipped. But beyond this figure, the ratio between the number of lenses and the number of bodies shipped (attachment rate) is interesting to observe.

On average, 1.65 lenses per box were shipped in 2024 – compared with 1.6 in 2023. However, there are considerable regional variations. In Japan, for example, there were a total of 2 lenses per housing. This ratio is 1.75 for America, and 1.65 for Europe. By contrast, it’s just 1.3 for China.

A rather cautious 2025 forecast

While the figures for 2024 are encouraging overall, CIPA – as is often the case – is rather cautious in its forecasts for 2025. The association expects overall growth of just 1%, and a 2.4% increase in target shipments.

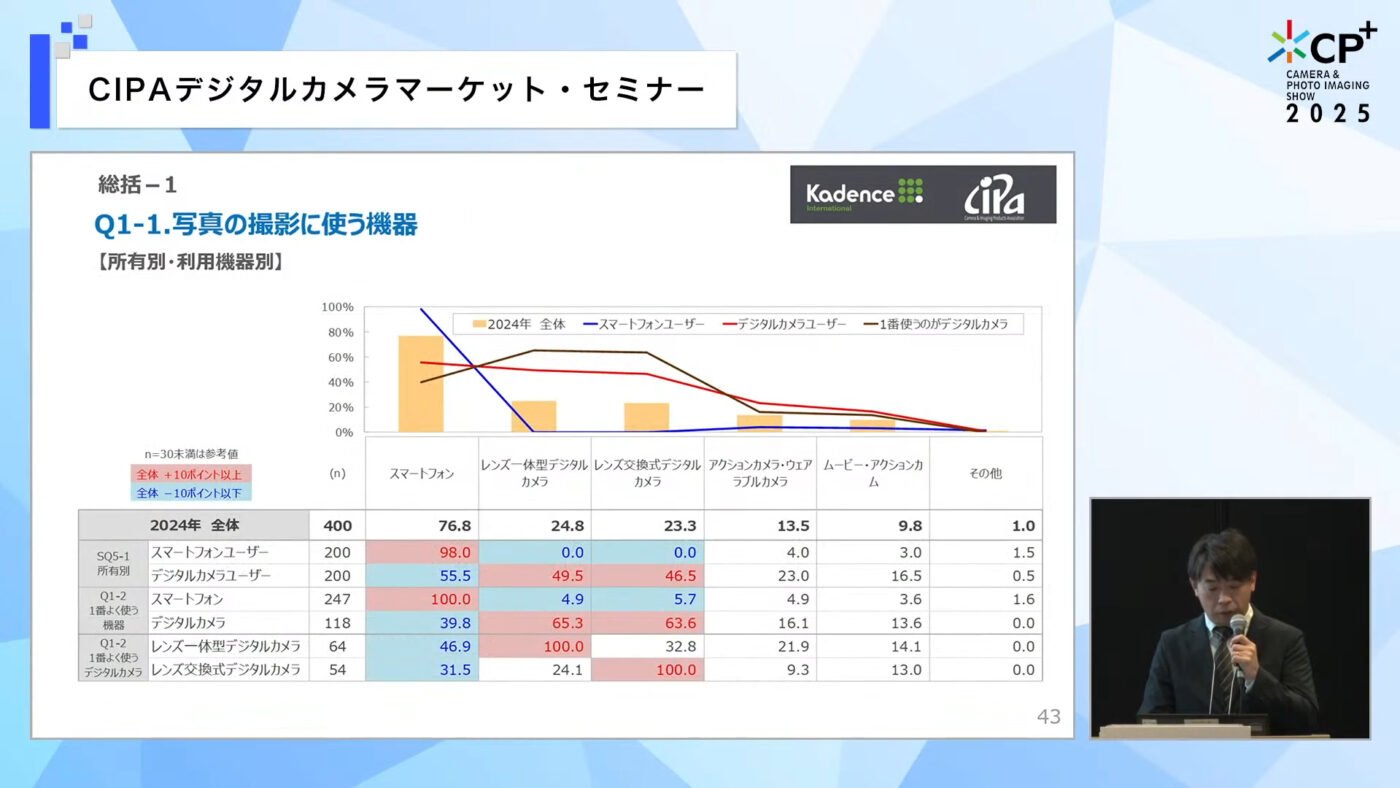

An interesting study of Chinese photographers

Finally, CIPA has published the results of a survey conducted between October and December 2024 among 400 photographers based in China. It shows that young people (under 29) take photos more frequently than their elders – and more often with their smartphones.

However, interchangeable-lens cameras are proving very popular, especially for portrait, landscape and food/drink photography. Where smartphones are favored for their convenience, digital cameras are preferred for the quality of the images they capture.

The study concludes that the future of the photo industry lies in retaining existing users – but also (and above all) in encouraging smartphone users to switch to a “real” camera.